The Role of Financial Oversight in Modern Business: CPA-Led Controllership and Financial Management Services

In today’s rapidly evolving business environment, financial accuracy, strategic foresight, and regulatory compliance are fundamental to sustainable success. As companies grow in size and complexity, the need for sophisticated financial oversight becomes increasingly demanding. Certified Public Accountant (CPA) firms, through their controllership and financial management services, offer an essential partnership that goes beyond conventional bookkeeping or tax preparation. These services not only ensure the integrity of financial reporting but also enhance operational efficiency, mitigate risk, and empower long term strategic planning.

Controllership as a Structured Discipline

Controllership, as a core function of financial governance, focuses on the accuracy, consistency, and reliability of a company's financial records. It encompasses internal controls, financial reporting, compliance assurance, and oversight of accounting processes. When handled by a CPA firm, controllership transforms from a routine operational task into a structured discipline aligned with best practices and regulatory expectations. These firms apply rigorous methodologies, including automation tools and industry benchmarks, to streamline processes such as monthly closings, reconciliations, and variance analyses. The result is improved financial clarity and reduced instances of error or misstatement, which directly strengthens decision making capabilities at the executive level.

Strategic Financial Management for Growth

In tandem with controllership, financial management services offered by CPA firms enable companies to develop strategic, forward looking financial plans. This includes budgeting, forecasting, capital allocation, cost modeling, and investment planning. By leveraging the expertise of CPAs, companies can align their financial strategies with their operational objectives. For instance, firms undergoing rapid expansion or those facing volatile market conditions benefit from scenario based forecasting and sensitivity analyses, which help anticipate disruptions and adjust expenditures accordingly. In this way, CPA-led financial management becomes not just a tool to sustain but a blueprint for growth.

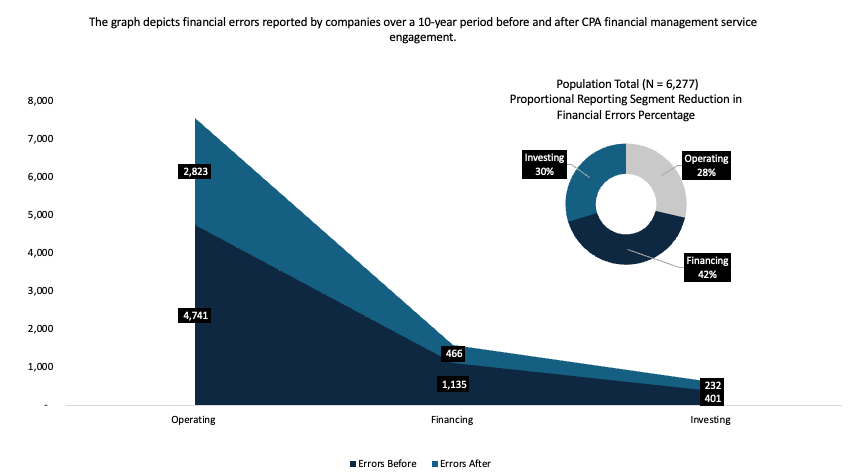

The population total is equal to the number of financial error observations (N = 6,277). The circle graph depicts the percentage change in before and after errors proportional to the total population. The average change (-) in financial errors in the population is 47% across all reporting segments.

Enhancing Internal Controls and Reducing Risk

A significant benefit of engaging CPA firms lies in their capacity to institute robust internal controls. Internal finance departments may be overwhelmed by day-to-day transactions or lack the cross functional insight necessary to design systems that prevent financial irregularities. CPA firms, in contrast, bring an external, independent perspective and a broad base of industry knowledge. Their implementation of tailored control mechanisms ensures that risks, ranging from fraud to misallocation of resources, are systematically mitigated. This layer of oversight is especially vital in highly regulated industries or businesses undergoing restructuring or mergers.

Furthermore, CPA firms serve as a strategic extension of a company’s leadership team, especially during periods of transition or uncertainty. Whether navigating mergers, securing funding, or adapting to regulatory changes, these firms provide actionable insights based on quantitative analysis and financial modeling. Their role is not merely technical but consultative, assisting executives in evaluating risks, prioritizing initiatives, and optimizing return on investment.

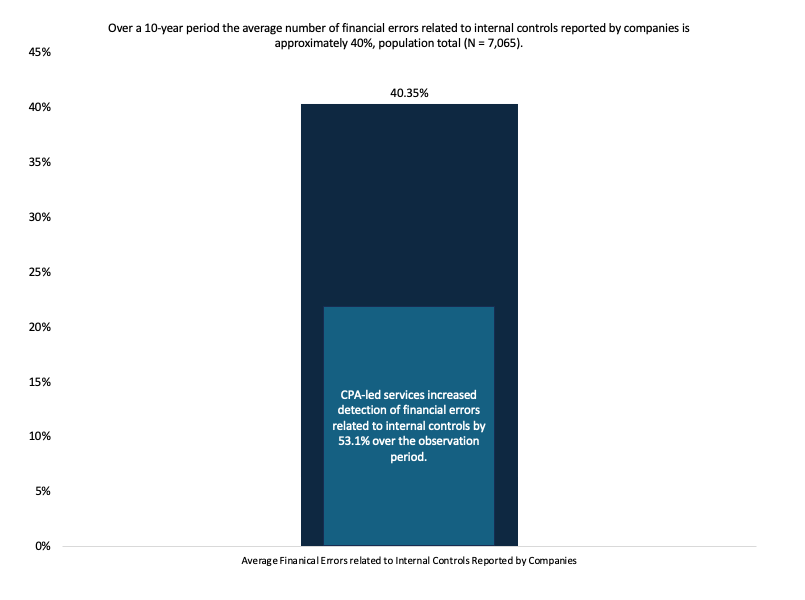

The population total is equal to the number of financial error observations (N = 7,065). The graph depicts the average number of financial errors related to internal controls reported by companies over a 10-year period. CPA-led services increased detection of financial errors related to internal controls by 53.1% over the observation period.

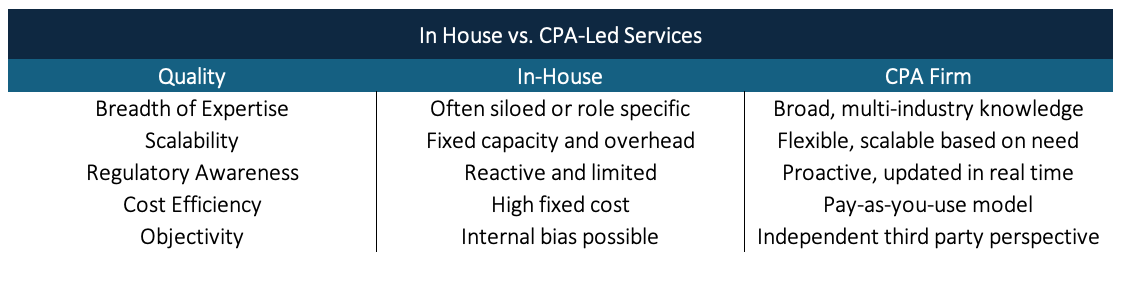

Comparison with Internal Financial Teams

In comparing CPA-led services with internal financial departments, several distinctions become evident. Internal teams, while familiar with company operations, often operate with limited bandwidth and are susceptible to internal bias. Their exposure to varied business models and regulatory environments is generally narrow. CPA firms, on the other hand, serve clients across multiple industries and stages of growth, equipping them with diverse perspectives and a deep understanding of best practices. Their services are also highly scalable, allowing companies to adjust support levels based on operational needs and fiscal capacity. This flexibility is particularly beneficial for mid-sized companies that require sophisticated financial guidance but cannot justify the fixed cost of a large in-house finance team.

Conclusion: A Strategic Imperative

In conclusion, the services offered by CPA firms in controllership and financial management are not ancillary; they are central to a company’s financial health and strategic trajectory. These firms provide a structured, professionalized approach to managing finances that goes far beyond basic compliance. By ensuring accurate financial reporting, instilling strong internal controls, and fostering long term planning, CPA-led services help companies navigate complexity, reduce risk, and achieve sustainable growth.

Why Partner with Us?

Gilbert & Company Certified Public Accountants P.C. is a trusted partner for industry sector firms, offering specialized support in controllership, assurance, tax compliance, sustainability, and financial advisory. Our advanced accounting techniques, combined with business intelligence and analytics, provide clients with the financial, regulatory, and operational insight necessary to thrive. By prioritizing data security, operational efficiency, and regulatory compliance, we enable organizations to focus on delivering high quality products and services to their clients.

Contact us to learn more about how our CPA services can empower your organization to excel. Together, we can help you achieve secure, compliant, and growth oriented operations, positioning you for long term success in your industry.